How to Get your Money $hit Together

by Max Phelps Monday January 20th 2020

The great thing about being a student from a financial standpoint, is that this is probably the most broke you’re going to be for the rest of your life. That means if you can learn to manage money well now, it’ll be a breeze when those graduate offers come flooding in to tempt you out of the library.

Although I was good with money as a student, I didn’t put in place the structures to stay good once I started working. As a result, I found that during my corporate career, the more I earned, the more we spent. I say ‘we spent’, because my wife is a much more talented spender than I am. We were lucky enough to meet during my gap year after uni and have been together ever since. Good structures work whether you’re single, or in a relationship, whereas a good money psychology only helps if you’re both wired the same way, or you stay single forever.

The basic problem with money is very simple really and it’s easiest to illustrate by thinking about cash. We’ve probably all experienced getting $100 or $200 in cash, only to see it magically vanish from our wallets, without really understanding where it went. In the days before debit and credit cards, everyone was paid in cash and knew the dangers of walking around with all their income in cash in their wallet the whole time. Most people worked out that the smart thing to do was to separate and hide as much money from themselves as possible and only walk around with what they needed. When that money ran out, it was a clear warning sign to stop spending and go home to get more, especially if they were out drinking!

These days we rarely see cash, yet we walk around with debit cards that give us access to all our income, or worse still, credit cards that give us access to money we haven’t even earned yet. On the plus side, we can look back at our account and see where the money all disappeared to, but on the downside, it all disappears anyway. My income in my first job was double the rate I could earn in the holidays at Uni and it doubled again within the first 2 years of working, yet we never seemed to save any money, no matter what our budget said. We simply spent the money in our accounts and there was none left to save, or we’d save and then dip into our saving to pay an unexpectedly high credit card bill.

Luckily after 11 years of spending most of our income, we stumbled across a solution that revolutionised how we managed our money. Later, when I got into finance, I found that most people have the same problem that we did. On the other hand, people that were good at saving were almost all managing their money the way we do now.

So what’s the solution?

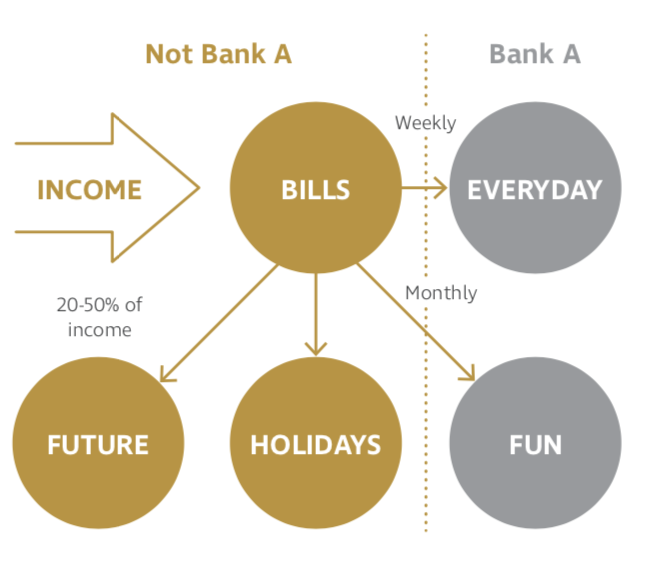

A minimum of five bank accounts, spread across two banks makes managing money easy.

Less than five accounts across less than two banks makes managing money hard.

Sounds crazy and complicated, doesn’t it? Yet it’s embarrassingly simple to set up and operate and much less stressful than trying to do everything with one transaction and one savings account with one bank.

The first trick is to separate the account our income lands in from the account we spend from. This does 2 things. Firstly, it lets us have a standard WEEKLY allowance, even if our income is fortnightly, monthly, or irregular, to do all the things we normally do every week (including buying food!). The account were our income lands gets labelled as ‘bills’ and if they give us a debit card for it, we cut it up, hide it, or simply keep it at home in a drawer so that we’re not tempted to spend that money. This is like the old days when people paid in cash would keep their rent and bills money, in a drawer, tin, or envelope at home.

The Everyday account is then ours to spend on whatever we want, without worrying about missing a direct debit for our phone bill, or not having any money for a holiday. Importantly if this is the only account with card access, the card will tell us when we’ve run out, with the “Not Approved” or “Declined” notification. It might be embarrassing for a few seconds, but it’s better to know where we’re at before we spend, than overspending and feeling like crap about it later.

Savings are split into three, so that the habit of spending our savings is reserved for the account labelled ‘Fun’. No matter when we get our income, we give ourselves an allowance MONTHLY on the 1st. It’s much easier to plan a month’s worth of spending when we can think about which birthday, anniversary, festival or event is coming up that we might need the money for. ‘Holiday’ is self-explanatory, but it’s important to keep it separate to the other 2 savings accounts, to give us something to look forward to and also set a budget for the next trip.

If all of this was done with one bank and the little ‘declined’ notice came up on our debit card, it’d be way too easy to nick money from the other accounts and ruin the plans. Also keep in mind that we’re not sober or sensible 24 hours per day, 7 days/week, so we shouldn’t let that version of ourselves make our financial decisions! The Everyday and Fun can be with one bank and the other accounts with another. Preferably one of the banks doesn’t have Osko – the instant transfer system between banks, otherwise the party animal in us might still make a bad decision.

Setting this up now, before the big $ comes in will make it much easier to make better use of higher incomes, than if we leave it to chance. It lets us flip the narrative from the more we earn the more we spend, to the more we can ACCESS, the more we spend.

Max Phelps

Money Coach with Golden Eggs and Author of ‘Getting Your Money $hit together’ – available on Amazon.